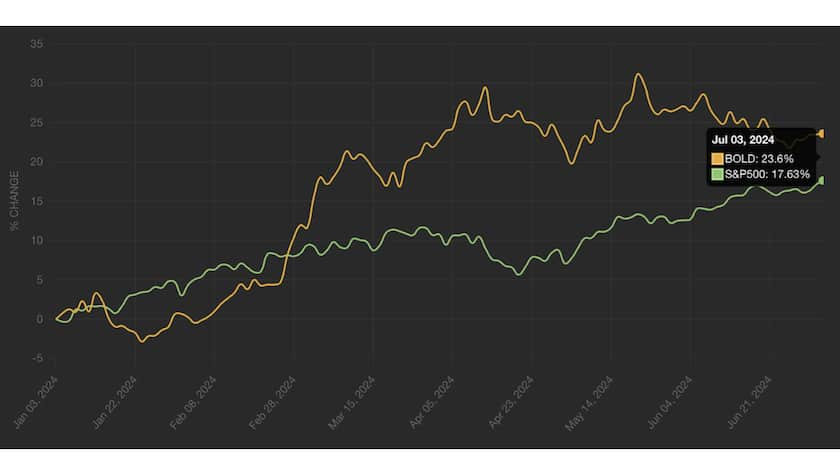

Year-to-Date (YTD) Performance of 21Shares Bytetree BOLD ETP (BOLD) in Orange vs. S&P500 in Green

As of July 3rd, 2024, BOLD has witnessed a price increase of 23.60% since the start of the year, remarkable compared to the S&P500 which has only seen a positive performance of 17.63% in the same time frame.

Why Invest in Bitcoin and Gold?

Well Established Inflation Hedge

Gold has long been recognized as a reliable physical hedge against inflation. Its value tends to rise when traditional currencies lose purchasing power, providing a safe harbor during economic turbulence. Gold's stability and historical performance make it a cornerstone in preserving wealth over long periods. Bitcoin, on the other hand, is often referred to as digital gold. It offers a new-age hedge against inflation and currency debasement. Like gold, Bitcoin is scarce, with a capped supply of 21 million BTC, which helps preserve its value over time thanks to a systematic and predictable monetary policy. Its decentralized nature and growing acceptance provide an innovative way to protect against the erosion of value in traditional currencies.

Combining both gold and Bitcoin in the 21Shares Bytetree BOLD ETP (BOLD) offers a diversified inflation hedge, balancing the historical stability of gold with the growth potential of Bitcoin. This combination allows investors to benefit from different economic environments, making BOLD a versatile investment choice.

Strong Past Performance

Bitcoin has consistently been one of the best-performing assets since its inception over a decade ago. Its performance has significantly outpaced many traditional asset classes. Bitcoin currently commands more than half of the total crypto asset market capitalization, with a market cap of over $1 trillion. This dominance, coupled with its liquidity and widespread acceptance, reinforces Bitcoin's position as a robust long-term investment vehicle. Gold has also performed admirably amid the rising global geopolitical tensions. According to recent data from the World Gold Council, gold prices have increased by 12% year-to-date. This performance underscores gold's resilience and role as a key asset in preserving wealth in uncertain market conditions.

Why invest in BOLD? Your Benefits at a Glance

21Shares Bytetree BOLD ETP (BOLD) tracks the performance of Bitcoin and Gold, featuring management fees of 1.49%.ETP.

Well-Designed Index

The Vinter Bytetree BOLD1 Inverse Volatility Index ("BOLD1") contains Bitcoin and Gold, weighted such that an equal amount of risk is invested into both assets. The more volatile Bitcoin is (relative to gold) the lower the target weight in Bitcoin. Periodic rebalancing brings the current weight to the target weights.

Risk-adjusted Weighting

BOLD's risk-adjusted weighting scheme is rebalanced monthly to provide an optimal blend of underlying assets: gold provides safety in a storm while Bitcoin captures the growth of a digital economy.

100% Physically Backed

BOLD is 100% physically backed by the underlying assets. The underlying gold is kept in institutional-grade custody by JP Morgan in London. The underlying Bitcoin is kept in cold storage by an institutional-grade custodian offering greater protection than custody options available to individual investors.

Carbon Neutral

Since 2018, 21Shares has been fully carbon-neutral. Our commitment involves offsetting our carbon footprint through green initiatives, like cleaner power generation, reforestation efforts, and coral reef protection, all geared towards safeguarding the planet for future generations.

21Shares Track Record

21Shares offers the world’s largest suite of cryptocurrency exchange-traded products, with over 40 products listed in 10+ exchanges, 21Shares is making cryptocurrency investing more accessible. In 2018, the company listed the world’s first physically-backed crypto ETP and continues developing their product suite with industry leading research and innovative products designed for institutional and retail investors around the globe.

21Shares Bytetree BOLD ETP (BOLD) at a Glance

| Product | 21Shares Bytetree BOLD ETP |

| Ticker | BOLD |

| ISIN | CH1146882308 |

| Inception Date | April 26, 2022 |

| Management Fee (TER) | 1.49% |

| Listing Avenues | SIX Swiss Exchange Euronext Amsterdam London Mercantile Exchange Deutsche Boerse Xetra Euronext Paris |

| Assets under Management ($) | 9.54 Million1 |

Information about 21Shares

21Shares offers the world’s broadest crypto product suite, including single assets, basket and tactical products, and are experts in the industry having launched the world’s first physically backed crypto ETP over 5 years ago. 21.co Group’s assets under management have amassed over $5 Billion in assets under management globally and continue developing their product suite backed by industry leading research to make crypto investing more accessible to everyone.

Contact Us

For additional information, please contact our us via phone:

- Zurich, ZH, Switzerland: +41 44 260 86 60

- New York, NY, United States: +1 212-223-3460

Or kindly email sales@21.co who will happily respond to questions regarding our products. For more information, please visit our website at https://21shares.com/.

--------------------------------

1As of July 3, 2024

Disclaimer:

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG in any jurisdiction. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever or for any other purpose in any jurisdiction. Nothing in this document should be considered investment advice.

This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.

This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States. Neither the US Securities and Exchange Commission nor any securities regulatory authority of any state or other jurisdiction of the United States has approved or disapproved of an investment in the securities or passed on the accuracy or adequacy of the contents of this presentation. Any representation to the contrary is a criminal offence in the United States.

Within the United Kingdom, this document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) persons who fall within Article 43(2) of the Order, including existing members and creditors of the Company or (iv) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Exclusively for potential investors in any EEA Member State that has implemented the Prospectus Regulation (EU) 2017/1129 the Issuer’s Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.

The approval of the Issuer’s Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the Issuer’s Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.

This document constitutes advertisement within the meaning of the Prospectus Regulation (EU) 2017/1129 and the Swiss Financial Services Act (the “FinSA”) and not a prospectus. The 2023 Base Prospectus of 21Shares AG has been deposited pursuant to article 54(2) FinSA with SIX Exchange Regulation AG in its function as Swiss prospectus review body within the meaning of article 52 FinSA. The 2023 Base Prospectus and the key information document for any products may be obtained at 21Shares AG's website (https://21shares.com/ir/prospectus or https://21shares.com/ir/kids).

21Shares is not an investment advisor and makes no representation regarding the advisability of investing in any such investment product or other investment vehicle. A decision to invest in any such investment product or other investment vehicle should not be made in reliance on any of the statements set forth on this website. Prospective investors are advised to make an investment in any such product or other vehicle only after carefully considering the risks associated with investing in such products, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment product or other investment product or vehicle. 21Shares is not a tax advisor. A tax advisor should be consulted to evaluate the impact and consequences of making any particular investment decision. Inclusion of any assets within an index is not a recommendation by 21Shares to buy, sell, or hold such security, nor is it considered to be investment advice. The website materials have been prepared solely for informational purposes based upon information generally available to the public and from sources believed to be reliable. No content contained in these materials (including index data, ratings, credit-related analyses and data, research, valuations, model, software or other application or output therefrom) or any part thereof (“Content”) may be modified, reverse-engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of 21Shares. The Content shall not be used for any unlawful or unauthorized purposes. 21Shares does not guarantee the accuracy, completeness, timeliness or availability of the Content. 21Shares is not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the content. The content is provided on an “as is” basis. 21Shares disclaims any and all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. In no event shall 21Shares be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages. Investments into crypto currencies and/or digital assets are subject to material and high risk including the risk of total loss. The calculated prices may not be achieved by investors as the calculated price is based on prices from different trading platforms. Furthermore, an investment into crypto currencies and/or digital assets may become illiquid depending on the trading platform or investment product used for the specific investment. Investors should carefully review all risk factors disclosed by the relevant trading platform or in the product documents of relevant investment products.